An act of kindness can bring a smile to the face of millions of vulnerable people across the world. This Ramadan, take time to invest in your akhirah and help those in need all around the world.

$0.00 for 1 dayDonate Now

If you’re trying to learn more about Zakat – the noble practice of Islamic charity – then you’re in the right place. Zakat is more than just a financial obligation; it is a means of purifying the soul and creating a just and caring society as a whole.

Zakat, derived from the Arabic word “Zakaah,” means purification and growth. In Islam, Zakat is one of the Five Pillars, a mandatory act of worship and charity. It is the act of giving a portion of one’s wealth to those in need, reminding us of the temporary nature of material possessions and the importance of compassion.

Beyond its financial aspect, Zakat serves essential purposes in Islam. It cultivates empathy and solidarity, fostering a sense of responsibility towards the less fortunate. Through Zakat, we strive to achieve social equity and uplift those who face financial hardships, enhancing the fabric of our communities. This timeless act of giving goes beyond addressing immediate material needs; it

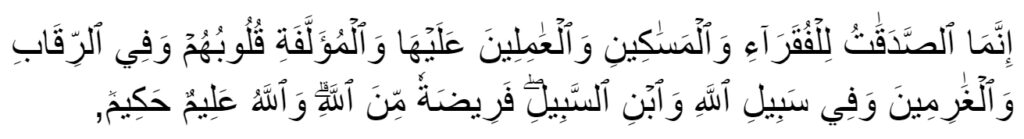

The impact of Zakat is far-reaching, reaching those who are most vulnerable. It is channeled to help the poor, the needy, debtors burdened by loans, and more. In the Holy Qur’an, those eligible to receive Zakat have been divided into eight categories:

“Zakah expenditures are only for the poor and for the needy and for those employed to collect [zakah] and for bringing hearts together [for Islam] and for freeing captives [or slaves] and for those in debt and for the cause of Allah and for the [stranded] traveler – an obligation [imposed] by Allah. And Allah is Knowing and Wise.” [Surah At Taubah (9:60)]

Essentially, the 8 categories consist of

We collaborate with reputable organizations and charities to ensure Zakat reaches those who need it most.

The obligation of paying Zakat, as mentioned in the holy Qur’an, does not apply to every Muslim. To be eligible for Zakat payment, certain conditions must be met. The obligation of paying Zakat, as mentioned in the holy Qur’an, does not apply to every Muslim. To be eligible for Zakat payment, certain conditions must be met. Zakat is binding on:

Fulfilling your Zakat obligation is made accessible through various means. Local Zakat centers, online payment platforms, and donations to credible organizations allow you to contribute conveniently. Be part of this noble journey and experience the joy of making a difference.

The Nisab is important in Zakat calculations as it helps determine who is eligible to pay Zakat and ensures that the obligation is fulfilled responsibly and in line with Islamic teachings.

The Nisab is the minimum threshold of wealth or assets that a Muslim must possess for Zakat to become obligatory on them. It serves as a benchmark to determine whether an individual has accumulated enough wealth to fulfill their Zakat obligation.

Use our Zakat calculator to determine your contribution accurately.

The Zakat amount you owe is determined based on the following calculations:

Assets eligible for Zakat include:

Exclude:

Beyond the tangible benefits of Zakat, there are profound spiritual rewards. The Quran and Hadith emphasize the blessings and merits of giving charity, elevating the status of the giver, and instilling a sense of contentment and gratitude.

Zakat is a transformative act of kindness that has the power to uplift lives and communities. Embrace the essence of Zakat and be a source of hope and compassion for those in need.

Take action today and entrust your Zakat with HADI Relief, ensuring it reaches those who truly need it. Witness the profound impact of your Zakat as it transforms the lives of deserving recipients. Together, let’s sow the seeds of positive change and create a world of caring and generosity.

Fulfil your Islamic Requirements

An act of kindness can bring a smile to the...

Fidya consists of a donation made when a person is...

Zakat ul Fitr (also known as Fitrana) is a charitable...

Human Assistance & Development International (HADI) is a 501 (c)(3) nonprofit organization based in the State of California (Tax ID# 95-4348674)

Follow us

PO Box 4598 Culver City, CA 90231

Select Donation Amount

Donation Total: $0

Want to double your donations?

Click the link below to be redirected

to an external website.